Strategic Investment Structuring

Turn Today's Income Into Multi-Generational Wealth.

For Successful Founders, Creators & Digital Entrepreneurs

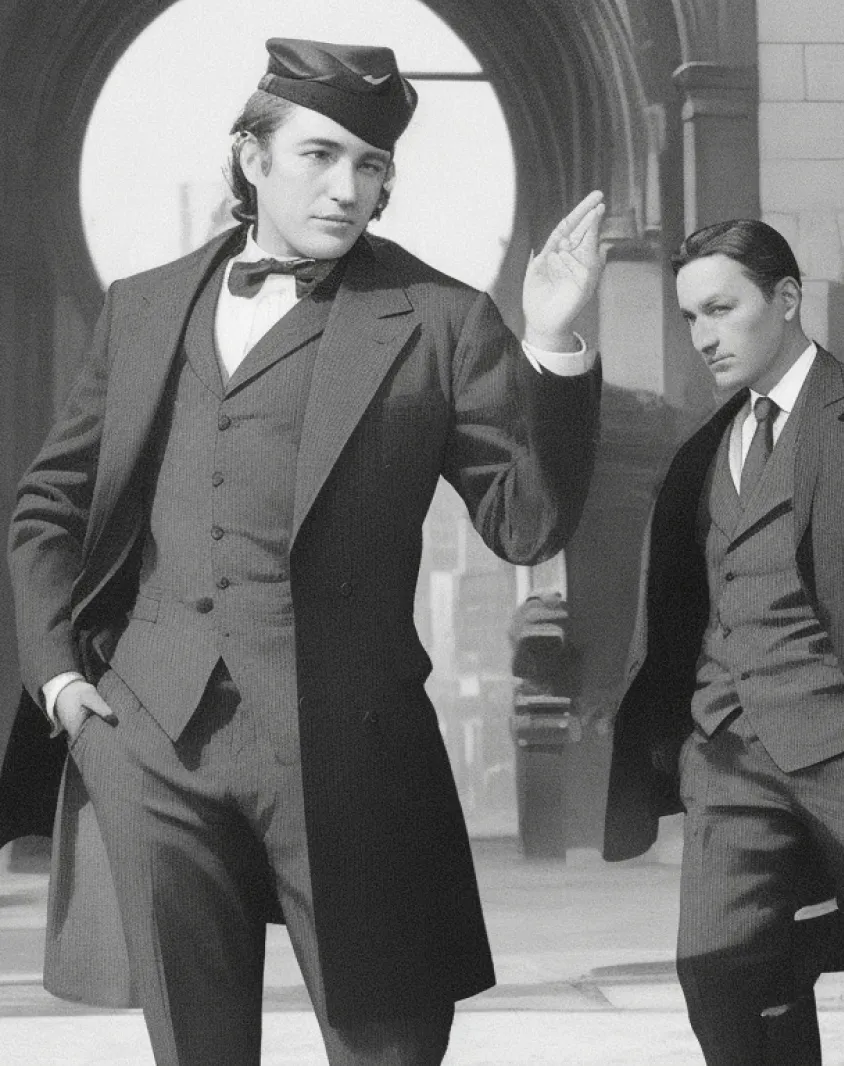

Raea Khan

Director & Principal

Why Your Wealth Isn't Growing Faster.

-

1High Taxes

Every dollar you overpay in tax is a dollar that isn't compounding. Your high tax rate is a direct brake on your wealth.

-

2Unstructured Global Investments

Investing globally without a legal strategy creates unnecessary risk, compliance headaches, & missed growth opportunities.

-

3No Generational Plan

Without a clear succession plan, your hard-won wealth can be diluted or lost in a single generation.

-

4Using a Domestic-Only Strategy

Your wealth is global, but your strategy is local. You're leaving powerful international tools & advantages on the table.

How We Grow Your Wealth.

As a Founder, creator or digital entrepreneur, you built your wealth in the new economy; this is how we make it grow for generations.

1

Tax-Efficient Investment Structures

We build a low-tax legal engine for your global investments using bespoke corporate & trust structures in optimal jurisdictions.

2

Unified Global Portfolio

We unify your international investments—from VC & real estate to digital assets—under a single, resilient, & compliant legal framework.

3

Multi-Generational Wealth Plans

We go beyond a simple Will, using sophisticated trusts & succession plans to ensure your wealth grows & transfers seamlessly for generations.

4

Jurisdictional Advantage

We leverage the unique advantages of different financial centres, helping you select the optimal jurisdictions for your holding companies & investment hubs.

We Advise the Top Entrepreneurs & Creators from:

Meet Your Wealth Advisors.

Real Case Studies.

The Twitch Streamer

Client: A top-tier Twitch streamer with high, fluctuating monthly income.

Challenge: Income was sitting idle in a personal bank account, losing value to inflation & taxes.

Solution: We created a tax-efficient holding company in Singapore to receive income & a managed investment structure.

Result: Their idle cash was transformed into a compounding global investment portfolio.

The TikTok Creator

Client: A viral TikTok creator with a new, multi-million dollar brand deal.

Challenge: Needed to structure the large, one-off payment for maximum long-term growth & asset protection.

Solution: We channeled the payment into a strategically layered corporate & trust structure in the BVI.

Result: The one-time windfall was secured & structured to fund their family's wealth for generations.

The OnlyFans Creator

Client: An elite OnlyFans creator with significant personal wealth.

Challenge: Wanted to use their earnings to build long-term, passive income streams outside of content creation.

Solution: We architected a bespoke trust structure to acquire international real estate & venture capital assets.

Result: Successfully diversified their wealth into income-generating assets for a secure future.

Who We Advise.

-

1Founders & Innovators

Your exit will create generational wealth. We build the plan for it now.

(For founders of disruptive tech, Web3, & global enterprises.) -

2Top-Tier Content Creators

Your income is massive, but it's not forever. We turn it into lasting wealth.

(For elite YouTubers, streamers, influencers, & OnlyFans models.) -

3E-commerce Leaders

You're scaling your business globally. We build the engine to scale your personal wealth.

(For leaders of online stores, DTC brands, & global e-commerce platforms.) -

4Agencies & Coaches

Your cash flow is huge. We make that cash flow work for you.

(For elite marketing agencies, high-ticket coaches, & top-tier consultants.)

Our Services:

What Do You Want to Achieve?

Pay Less Tax

We use international tax laws to legally cut your global tax bill.

Protect Your Assets

We build legal fortresses to make your wealth untouchable.

Grow Your Wealth

We design tax-efficient structures for your global investments.

Live Anywhere

We provide the strategic planning for you to live, work, & operate globally.

Frequently Asked Questions.

Do You Work with Anyone?

No. We work with select founders, creators, & entrepreneurs with USD $10 million+ in global assets who want to turn their high income into lasting, multi-generational wealth.

Is this just financial planning or investment advice?

No. Financial planners help you manage your money. We architect the legal and corporate structures your money grows inside. This is the foundational level that makes true multi-generational wealth possible.

What is the core of your "wealth growth" strategy?

Our core strategy is building a tax-efficient, global engine for your capital. We use sophisticated international trusts and corporate entities so your wealth compounds in an optimal, protected environment.

Why can't my local accountant or lawyer do this?

Local advisors are experts in one system. The “New Rich” operate in a borderless economy. We are specialists in navigating the interaction between multiple legal and tax systems to create a single, unified global strategy.

How does "structuring" actually help my wealth grow?

Every dollar saved on tax is a dollar that can be reinvested. A tax-efficient structure is a powerful growth accelerant, allowing your wealth to compound significantly faster than with a standard domestic setup.

Is this only for "old money"?

This level of strategic planning was traditionally reserved for old-money dynasties. We have adapted these powerful, time-tested principles for the unique challenges and opportunities of the new economy’s leaders.

What does a "tax-efficient investment structure" look like?

It’s a bespoke legal architecture, often involving a holding company in a strategic jurisdiction and international trusts. This allows your investment profits to grow in a low or zero-tax environment before you decide to access them.

How does this help with a future business exit?

A major liquidity event like selling your company can trigger a massive tax bill. We pre-emptively build the structure so that when you exit, the proceeds flow into a protected, tax-efficient environment, preserving your windfall.

What is "legacy architecture"?

It’s the difference between leaving your family money and leaving them a dynasty. We design dynamic, multi-generational trust structures that protect wealth from being diluted or lost over time, ensuring your success lasts for generations.

Why should I trust your team with this?

Our counsel is a unique fusion. Raea Khan brings a modern, risk-aware perspective from high-stakes corporate deals, while Mark Lea brings 50+ years of foundational wisdom from advising Rothschilds and writing the trust laws for nations.

Ready to Start?

Request a personal consultation with us to understand how we can serve you.

Note: We only work with a select number of clients.